It may be difficult to procure resource having an effective foreclosed family

A significant difficulties when selecting a good foreclosed residence is these instructions usually are generated sight-unseen. This really is eg well-known in the auction setup, due to the fact people get minimal or no use of the inside of the house before generally making a quote. Mollo cards that comparable functions in your neighborhood gives prospective consumers an idea in what they might be set for. Check other comparable virginia homes and society, and acquire as frequently record into assets as you’re able to, he recommends. The greater studies and you may believed, the greater amount of wishing you are buying a good foreclosed domestic.

Whenever possible, an extensive inspection can help inside the distinguishing the fresh new scope out of performs called for and estimating the resource required for fixes. Regrettably, regarding property foreclosure, conversion process inspections may well not take place until shortly after an offer is actually approved. Particular foreclosures deals allows customers so you can move out of buy immediately after inspection when they select the house are too much of a carrying out. Although not, it’s still vital that you know fix and you can restoration can cost you, because they is somewhat impact the complete cost and you can feasibility out of the purchase.

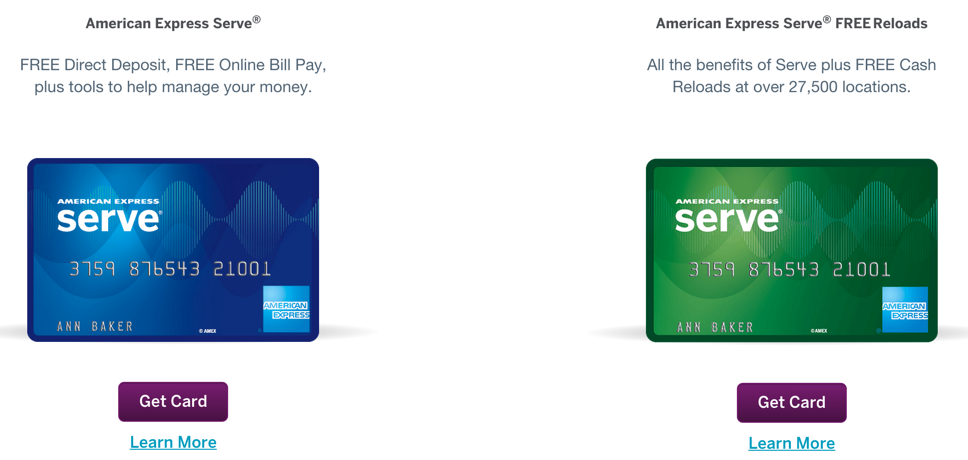

Securing financing getting a foreclosed household could be more problematic than simply getting that loan for a property under typical things. Using their both poor reputation, foreclosed residential property usually dont meet the first criteria required by loan providers to own a fundamental mortgage. Traditional loan providers can also perceive increased chance during the funding foreclosure as a result of the unpredictability of the property’s genuine market value and you can the opportunity of undetectable will set you back. Potential buyers may wish to speak about its alternatives that have one of the best mortgage brokers (such as for example PNC Lender otherwise Caliber Lenders) before you begin the lookup.

Consumers may also should talk about regulators-backed financing, many of which serve foreclosed home instructions. One such mortgage is the Fannie mae HomePath system, that helps earliest-time people get REO characteristics. An alternative choice is the FHA 203(k) rehab financial. Even in the event perhaps not specific in order to foreclosed features, so it loan particular lets people to finance both the purchase and the new required renovations compliment of one mortgage. Ultimately, a check cashing place near me those people to buy foreclosed house due to the fact capital attributes may be selecting researching the best funds having turning homes.

Buyers may find term issue such liens.

Homeowners must be aware about possible term difficulties, that will notably perception its purchase transaction. Liens and other courtroom burdens can also be occur out of delinquent expense by earlier people, such property fees, contractors’ charges, and other secured loans that were perhaps not removed until the foreclosure. These problems can possibly prevent the fresh new transfer out of a definite title in order to the newest manager.

A thorough term research will figure out any liens or a great claims towards property, delivering an insight into exactly what has to be solved ahead of continuing. This helps end unforeseen monetary liabilities and courtroom difficulties immediately following to shop for. Title insurance has the benefit of cover against future says which could maybe not getting recognized from inside the initially term look.

Faqs

Possible buyers are bound to provides more questions relating to purchasing a foreclosed house. Understanding the newest answers to some typically common requests may help kick-begin its browse.

Great things about To acquire good Foreclosed Family

Above all, consumers need to meticulously evaluate their finances and ensure it enjoys a pile of cash disperse for potential fixes. The strategy is to find that have including a savings [that] some thing included in inspection afterwards is in budget to resolve, says Severino. If you overpay, you can find few things you can do so you can salvage the fresh funding, [but] when you get plenty you to definitely leaves area to your treatment budget, carrying will set you back, and you will money, you might victory.