Instance of a lengthier against. Quicker Rv Financing

A frequent time period for a leisure vehicles (RV) loan are 10 to 15 many years, in the event one may see Camper money having smaller or lengthened terms, with regards to the financial as well as how much you need to acquire.

If you’ve ever got an auto loan, your probably remember that these include normally quicker in contrast. Camper fund are going to be extended since you ount of money. You could find differences in just what you’ll be able to pay money for a keen Camper mortgage inside the attract and you will costs and you can the needs so you can meet the requirements.

Key Takeaways

- Rv mortgage conditions usually include 10 to 15 decades, though they truly are faster otherwise offered based your needs plus the RV’s costs.

- Versus auto loans, Rv funds may vary pertaining to all of the focus rates offered while the charge you can spend.

- Choosing a smaller-label loan makes it possible to repay the Camper quicker if you’re helping you save money on notice.

- Placing additional money down is one way to minimize how much you need to use having an enthusiastic Rv loan.

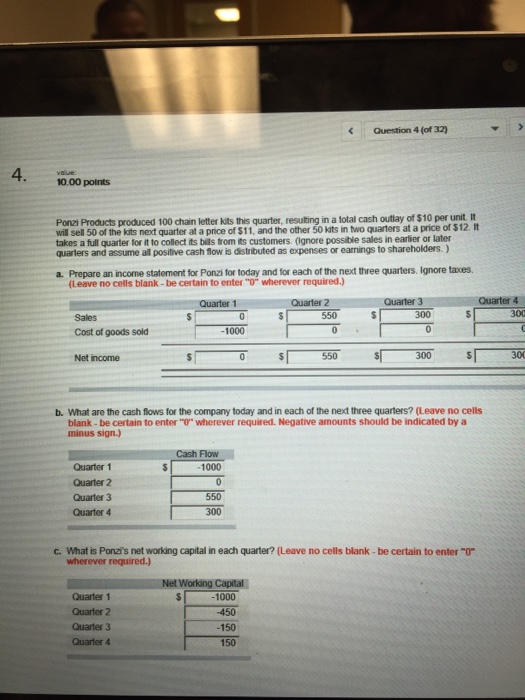

Whenever you are looking for an Rv financing, discover a hefty difference between cost and costs anywhere between a smaller- and expanded-identity mortgage. Just to illustrate one depicts how much you might shell out playing with several other loan terminology.

As you care able to see, the 5-year loan choice saves you slightly below $43,000 into the appeal charge. That is a hefty deals, but your payment is more than twice just what it was with good 15-year financing. When you compare a shorter against. extended Rv mortgage title, you should considercarefully what issues really to you personally: sensible repayments or notice coupons.

Alerting

An enthusiastic Rv mortgage that have an adjustable interest rate shall be risky when the costs increase. High costs increases their payment and complete interest.

Situations That affect Your Rv Loan Term

Different factors is also influence their Rv mortgage label and exactly how much it is possible to pay monthly along with overall. Focusing on how these types of funds works can help you find the correct mortgage for your problem.

Amount borrowed

Extent you ought to acquire can in person apply at your loan term. The higher the mortgage, the fresh new lengthened the definition of may be. The financial institution ount which is borrowed. Or if you is given the substitute for prefer a shorter otherwise expanded loan term, based on how far you want so you’re able to borrow.

Style of Rv

Extent you could acquire along with your mortgage identity is be calculated to some extent of the form of Camper you are to find. Such as for instance, lenders may offer various other investment words dependent on whether you are to purchase the newest or utilized. There’ll also be differences in financing words predicated on duration or whether or not the Camper has unique otherwise high-technical has.

Rv Ages

The age of brand new Rv that you will be trying to find to order are also essential, because the loan providers can get maximum mortgage conditions to own old activities. That have to manage having just how RVs depreciate inside really worth more than time. Loan providers is generally averse to help you extending fund having possessions which can be likely to clean out most of their well worth before the financing title finishes.

While it’s you’ll locate Camper resource to possess older patterns, specific lenders may only offer funds Susan Moore loans to have RVs that will be no more than 10 to 15 yrs old.

Credit scores

When making an application for whichever financing, along with a keen Camper mortgage, lenders have a tendency to think about your credit reports and ratings. Their fico scores give lenders exactly how in control youre whether it comes to managing borrowing and you will debt.

A higher credit history can assist you to qualify for even more favorable mortgage terms and interest levels. A good credit score tends to be 670 in order to 730 on the FICO credit rating assortment. In this assortment, you routinely have a good chance of going recognized within very good costs, even in the event each financial possesses its own conditions.