Accounting Ratios With Formulas And Calculators

The goal may be to hold current levels steady or to strive for operational growth. A business’s financial statements include many figures and may not make much sense. Accounting ratios are calculated on a periodic basis, usually yearly or quarterly, to accrual accounting analyze a company’s cash flow and financial situation. Liquidity ratios are similar to debt ratios in that they are used to calculate a company’s indebtedness. But they do not consider all assets and liabilities for a company in their calculations.

What are my business financial ratios?

- This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy.

- Examples include Debt Ratio, Debt to Equity Ratio and Interest Coverage Ratio.

- This is done by financing the company’s assets with debt, which requires a fixed payment of interest.

- Investors and analysts use ratio analysis to evaluate the financial health of companies by scrutinizing past and current financial statements.

- Use the Debt Ratio Calculator to calculate the debt ratio from your financial statements.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Our tutorials on accounting ratios give full details about the use of accounting ratios and their calculation. Sustainable Growth Rate is the maximum growth rate of a company if none of its ratios change and it does not raise new capital through selling shares.

Investment

Additionally they are used by investors, analysts, and management to assess the profitability, liquidity, solvency, and efficiency of the business. The ratios are a relative measure of two or more values taken from the financial statements of a business and can be expressed as a decimal value such as 0.45 or as a percentage e.g. 45%. For example, net profit margin, often referred to simply as profit margin or the bottom line, is a ratio that investors use to compare the profitability of companies within the same sector.

How confident are you in your long term financial plan?

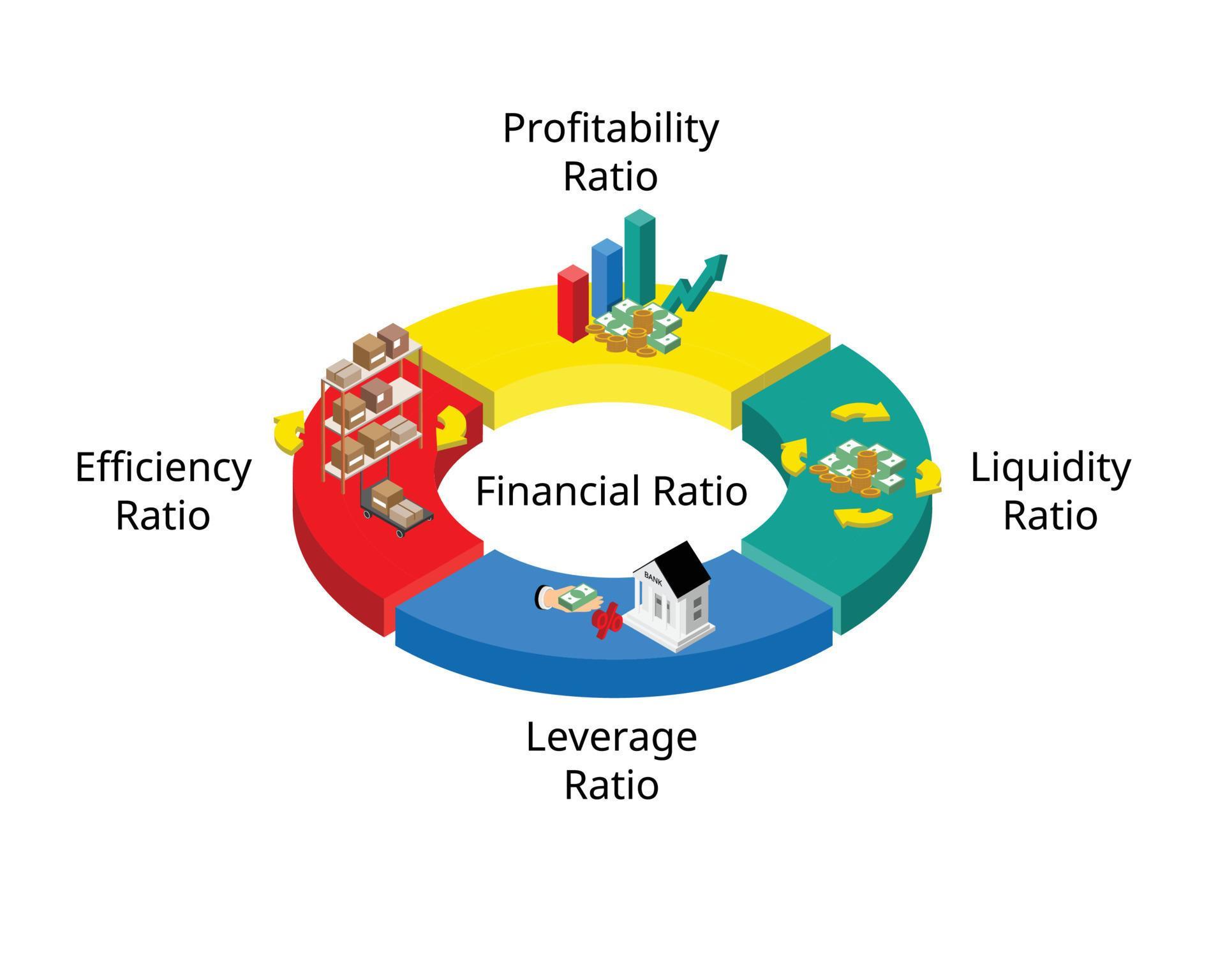

The higher the dividend payout ratio, the higher the percentage of income a company pays out as dividends rather than reinvesting back into the company. Several types of accounting ratios can determine various types of information. The financial ratios available can be broadly grouped into six types based on the kind of data they provide.

Accounting Ratios with Examples

Liquid assets include cash and anything that can be easily converted to cash. They include marketable securities, government bonds, foreign currencies, and treasury bills. The number can fluctuate when employees exercise stock options or if the company issues more shares.

Would you prefer to work with a financial professional remotely or in-person?

The Return on Invested Capital measure gives a sense of how well a company is using its money to generate returns. Comparing a company’s return on capital (ROIC) with its cost of capital (WACC) reveals whether invested capital was used effectively. Tech companies make fewer capital investments as compared to traditional companies. But the services of major tech conglomerates like Google and Facebook are free. These are just a few examples of the many accounting tools that corporations and analysts use to evaluate a company, however. Many other tools highlight different aspects of a company so you’ll want to explore and potentially use them as well.

Use the Working Capital Turnover Calculator above to calculate the working capital turnover from you financial statements. Inventory Turnover Period in Days measures how many days it takes for a company to turnover its entire inventory. Use the Average Days Sales Calculator to calculate the average days sales from your financial statements.

The same cannot be said of a company operating in the manufacturing industry because inventory turnover is the lifeblood of its operations. Debt ratios measure a company’s long-term ability to pay off its debt obligations. To perform ratio analysis over time, select a single financial ratio, then calculate that ratio at set intervals (for example, at the beginning of every quarter).

Price to Book Ratio tells us the relative value the market places on the company to the accounting valuation. This ratio provides a basic understanding of residual value of a company should it go bankrupt. Debt Servicing Ratio is used to assess a company’s ability to meet all of its debt repayment obligations, both interest and principal repayments.

Use the Fixed Asset Turnover Calculator to calculate the fixed asset turnover from your financial statements. Use the Inventory Turnover Calculator to calculate the inventory turnover from your financial statements. Use the Earnings per Share Calculator above to calculate the earnings per share from your financial statements.

Instead, liquidity ratios restrict their calculations to current assets and liabilities to measure the company’s liquidity or ability to service short-term debt. The gross profit margin would be 80% if gross profit is $80,000 and sales are $100,000. It indicates that a company is keeping a higher proportion of revenues as profit rather than using it to meet expenses. Analyzing accounting ratios is an important step in determining the financial health of a company.

Replica rolex Daytona present an accessible avenue for watch enthusiasts who yearn to bask in the aesthetics.